In a recent development, KPMG and Hainan Ecological Software Park have cemented a collaboration in cross-border services. Signing a strategic agreement, the two entities aim to foster industry growth, enhance corporate services, and streamline event organization. Their combined efforts are geared towards assisting Chinese enterprises in global expansion while enticing foreign companies to venture into China.

Hainan Ecological Software Park is currently spearheading the creation of a data-centric online and offline cross-border service platform. With plans for a comprehensive cross-border service window, the park endeavours to offer extensive support for companies venturing abroad or entering the Chinese market.

Notably, the park has established a streamlined approval channel termed “fast-track” for Outward Direct Investment (ODI) projects. Collaborating with Qualified Domestic (QD) pilot fund managers, it facilitates QD investments, thereby enabling companies to benefit from tax exemptions on new overseas investment income.

On the flip side, for inbound investments, the park assists in securing Qualified Foreign Limited Partnership (QFLP) qualifications and Hainan Free Trade Port multifunctional (electronic fence) free trade accounts, simplifying cross-border capital flows.

Additionally, the park extends services for overseas listings, encompassing listing incentives, structural setup, and cross-border tax consultancy, thus offering a comprehensive suite of efficient cross-border investment and financial services.

The relationship between the two parties is underpinned by the broader canvas of the Hainan Free Trade Port and its distinctive policy ecosystem.

Hainan is fast-tracking the establishment of the free trade port to be fully operational by the end of 2025. Crucially, the groundwork for “free and convenient trade,” “free and convenient investment,” “free and convenient cross-border capital flow,” and “free and convenient personnel movement” is already well underway. Experts opine that the policy framework positions the Hainan Free Trade Port as a mature headquarters for managing cross-border trade and investments for Chinese enterprises.

Unique Advantages of Hainan Free Trade Port:

1. Low Taxation Costs:

In line with the “Overall Plan for the Construction of the Hainan Free Trade Port,” Hainan is implementing a tax regime conducive to a high-level free trade port, characterized by “zero tariffs,” “low tax rates,” and “simple tax systems.” Noteworthy tax policies include:

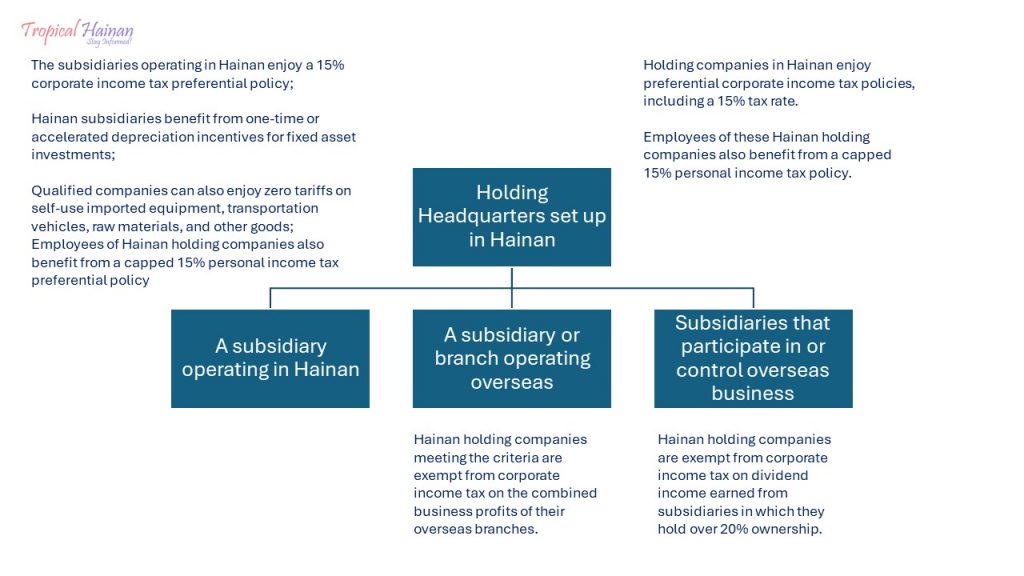

Corporate Income Tax: Enterprises established and operating substantially within the Hainan Free Trade Port enjoy a reduced corporate income tax rate of 15%. Moreover, income from overseas direct investments by designated industries is exempt from corporate income tax. The policy also allows for deductions on fixed assets or intangible assets, further alleviating the tax burden.

Individual Income Tax: High-end talents and those in demand working within the Hainan Free Trade Port are exempt from individual income tax exceeding 15%.

Zero Tariffs: Certain categories of imports, including transportation vehicles and raw materials, benefit from zero tariffs within the Hainan Free Trade Port.

2. Free and Easy Personnel Movement:

Hainan’s visa-free policy spans 59 countries, allowing a 30-day visa-free stay for various purposes. Additionally, recent facilitation measures introduced by the provincial authorities enhance the ease of entry and residency for foreigners, significantly improving the environment for foreign professionals.

3. Unrestricted Cross-Border Fund Flow:

The People’s Bank of China Hainan Branch has introduced administrative measures facilitating the free flow of funds across multifunctional free trade accounts within the Hainan Free Trade Port and beyond. Enterprises operating within the port enjoy unprecedented ease in managing cross-border fund transfers, bolstering financial efficiency and flexibility.

Under the structure of a holding company, headquarter companies can enjoy the unique tax preferential policies of the Hainan Free Trade Port.

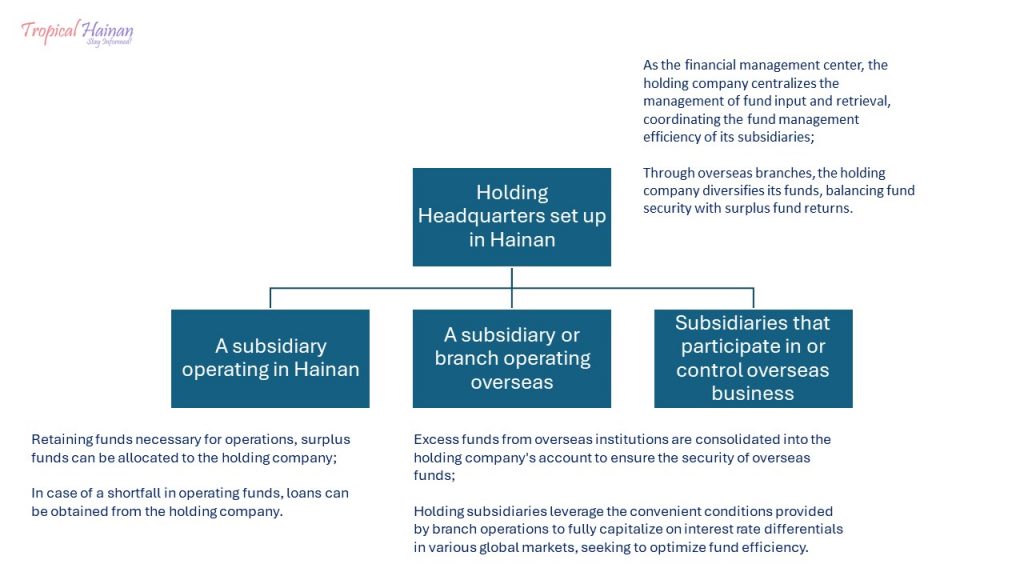

Using the holding company as a global centre for funds and foreign exchange provides advantages such as facilitating the secure management of funds for overseas branch operations, pursuing high-yield investment opportunities, and enhancing the efficiency of fund utilization.

The convergence of favourable policies and a conducive business environment in the Hainan Free Trade Port presents a ripe opportunity for establishing international investment holding headquarters. Whether for managing local operations, controlling overseas businesses, or leveraging tax advantages, Hainan is emerging as an enticing destination for enterprises aiming to capitalize on global opportunities while navigating a tax-efficient and streamlined regulatory landscape.

For business queries, contact us at business@tropicalhainan.com

Related article: Compilation of important policies for Hainan Free Trade Port (February 2024)